After a DUI conviction, expect significant increases in insurance rates as insurance companies assess higher risk profiles. To mitigate these adjustments, drivers should consider options like increased deductibles, switching to higher-deductible plans, or exploring specialized insurers. Disclosing DUI convictions accurately when applying for travel insurance is crucial to secure suitable coverage and avoid unexpected financial burdens. Understanding local traffic laws abroad is essential for safe driving and avoiding substantial fines or jail time, which can also impact insurance rates post-DUI incidents. Proactive measures like maintaining a clean record and shopping around with insurers can help manage Insurance Rate Adjustments after DUI.

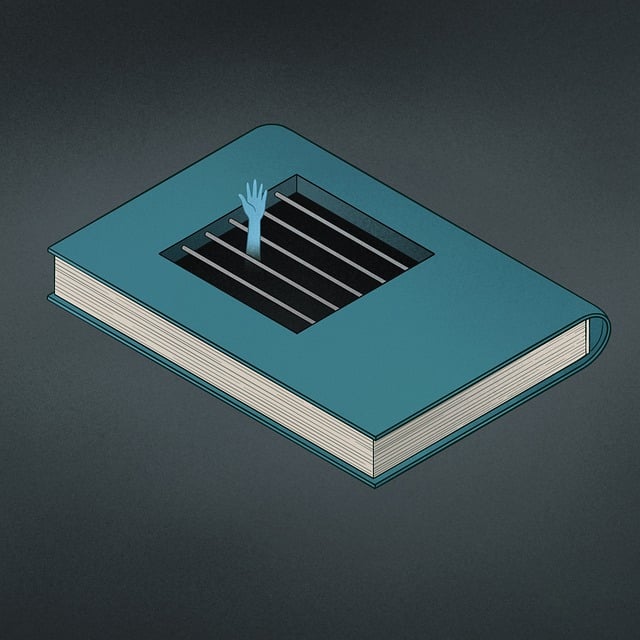

International travel can be an exciting adventure, but navigating foreign roads post-DUI conviction requires careful consideration. This article provides essential safe driving tips and insights into the impact of DUI on your insurance. Understanding how DUI convictions adjust insurance rates globally is crucial for responsible travelers. Learn about local traffic laws, reduce insurance costs, and ensure a smooth journey by following these expert recommendations.

- Understanding Insurance Rate Adjustments Post-DUI

- The Impact of DUI on International Travel Insurance

- Essential Safe Driving Practices Abroad

- Navigating Local Traffic Laws and Regulations

- Tips for Reducing Insurance Costs After a DUI Conviction

Understanding Insurance Rate Adjustments Post-DUI

After a DUI (Driving Under the Influence) conviction, individuals often face significant adjustments in their daily lives, and one such area is their insurance rates. Insurance companies typically reassess risk profiles post-DUI, which can lead to substantial rate increases. This adjustment is necessary as DUIs indicate higher potential risks associated with insuring an individual. Drivers may notice a spike in their premiums, especially for auto policies, due to the added burden of legal consequences and the heightened perception of safety risks.

Understanding these Insurance Rate Adjustments after DUI is crucial. Drivers should be prepared for potential changes and consider options to mitigate the impact. This might include increased deductibles, switching to higher-deductible insurance plans, or even exploring specialized insurers that cater to high-risk drivers. It’s a step towards responsible financial management and ensuring adequate coverage while navigating the aftermath of a DUI conviction.

The Impact of DUI on International Travel Insurance

Drunk driving (DUI) can significantly impact your ability to obtain international travel insurance, and it often results in higher insurance rate adjustments. Insurance companies consider DUI a significant risk factor due to the potential for accidents and associated medical expenses abroad. A single DUI conviction can lead to denial of coverage or severely elevated premiums, making future trips more expensive.

In some cases, individuals with a DUI history may only be eligible for specialized travel insurance policies with strict limitations and higher deductibles. This is because insurers mitigate their risk by charging higher rates to offset potential claims. Therefore, it’s crucial to disclose any DUI convictions accurately when applying for travel insurance to ensure coverage suitability and avoid unexpected financial burdens during your travels.

Essential Safe Driving Practices Abroad

When traveling internationally, adhering to safe driving practices is crucial, especially as traffic rules and road conditions can vary significantly from one country to another. Before embarking on your journey, familiarize yourself with the local driving laws and regulations. Each country has its own set of rules, and understanding these will help you avoid costly insurance rate adjustments after DUI incidents or other accidents.

Remember that road signs and signals may differ, so stay alert and use caution when navigating unfamiliar roads. Adjusting to new driving conditions, such as different speed limits, traffic patterns, and even vehicle standards, is essential. Always drive defensively, anticipate potential hazards, and be mindful of local customs and driving etiquette to ensure a safe and enjoyable trip.

Navigating Local Traffic Laws and Regulations

When traveling internationally, understanding local traffic laws is crucial for safe driving and avoiding hefty fines or even jail time. Each country has its unique rules and regulations, so it’s essential to familiarize yourself with them before hitting the road. Speed limits, traffic signals, and lane markings might differ significantly from what you’re used to at home. Take the time to read up on local laws, consider renting a car that complies with regional standards, and be mindful of any cultural differences in driving behavior.

Remember, breaking local traffic laws can lead to not only monetary penalties but also insurance rate adjustments after DUI incidents. In some countries, even minor infractions can result in significant rate hikes or even a temporary suspension of your driver’s license. To protect yourself, stay alert, follow all signs and signals, and drive defensively.

Tips for Reducing Insurance Costs After a DUI Conviction

After a DUI (Driving Under the Influence) conviction, one of the significant impacts you’ll face is an increase in your insurance rates. This adjustment in premiums is a direct consequence of the heightened risk associated with insuring drivers who have been convicted of impaired driving. However, there are several proactive steps you can take to mitigate these Insurance Rate Adjustments after DUI.

Firstly, maintain a clean driving record post-conviction. Avoid any further traffic violations or accidents, as these could lead to additional rate hikes. Secondly, consider completing a defensive driving course. Many insurance companies offer discounts for drivers who complete such courses, demonstrating improved driving skills and a lower risk profile. Lastly, shop around for new insurance quotes. Different providers have varying policies regarding DUI convictions and their impact on rates; comparing options can help you find a more affordable rate.

When planning international travel post-DUI, understanding the implications on your insurance rates and adopting safe driving practices abroad are paramount. By navigating local traffic laws, reducing insurance costs, and adhering to essential safety guidelines, you can ensure a smoother journey and potentially mitigate insurance adjustments. Remember, responsible driving behaviors not only protect you but also contribute to a positive experience when traveling internationally after a DUI conviction.